The biggest sales event of the year, Black Friday, is now in the rear mirror, and today, we would like to look at how it went.

So grab a cup of coffee and dive into this year's Black Friday industry performance figures!

The information we present today is gathered from webshops using Hello Retail, and we compare it to the previous year’s performance. To increase accuracy, we are only looking at shops that have used Hello Retail during both Black Friday periods – last and this year’s. Doing so helps us find insights about how different industries perform, when customers spend the most money, and when they tend to buy during the day. Knowing your customer base is essential, and the way to learn about it is to look at your historical data.

Term explanation

MOV

(Median Order Value)

If you line up all orders placed on your shop, from the smallest to the largest, and then take the value in the middle, that is the median.

AOV

(Avarage Order Value)

If you sum all order values and divide by the number of orders, you get the AOV.

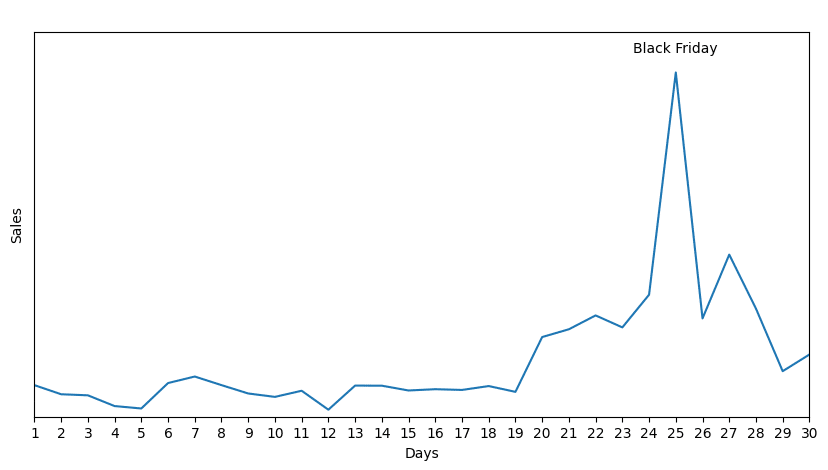

For many shops, Black Friday did not kick off at midnight but started a week before – the so-called Black Week.

Looking back at the number of sales we saw during November, it is clear that Black Week kicks off the shopping with increasing sales. The day of Black Friday is when we see the highest peak in sales.

Interestingly enough, purchases on the 28th of November (Cyber Monday) are not spiking. Instead, they are around the same level as during Black Week. The second high spike in sales appears on the Sunday after Black Friday, which probably corresponds with customers taking advantage of the last deals that will be ending.

This year has been a hard year with many things to worry about in society and it is also reflected in how customers shop online. Below you can find how the shops have been performing this year, compared to the last Black Friday event.

| Revenue | Orders | MOV | AOV | |

|---|---|---|---|---|

| Black Friday | -8,9% | -0,3% | -4,7% | -8,6% |

| Black Week | -3,7% | 2,3% | -2,3% | -5,8% |

Revenue is almost down 9 % on Black Friday, but shops are not focusing as much on Black Friday any longer, but more on Black Week! If we compare Black Week of 2021 to 2022, we see that the revenue has dropped by 3.7 %. The conversions during Black Friday have dropped by 0.3 %, but if we look at the whole week, it has increased by 2.3 %.

This is interesting to see because it shows that customers are still willing to do their shopping but are choosing the cheaper variants of products. This is reflected in how both the Median Order Value (MOV) and the Average Order Value (AOV) have dropped compared to last year. It also goes to show that the success of Black Friday is not based solely on one day but the whole of Black Week.

Let's dive into more data

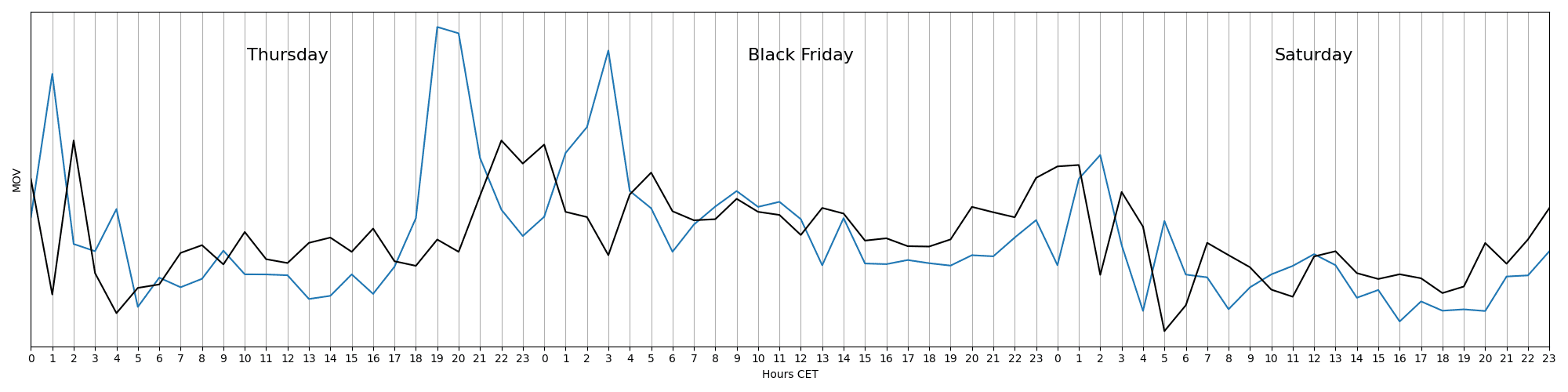

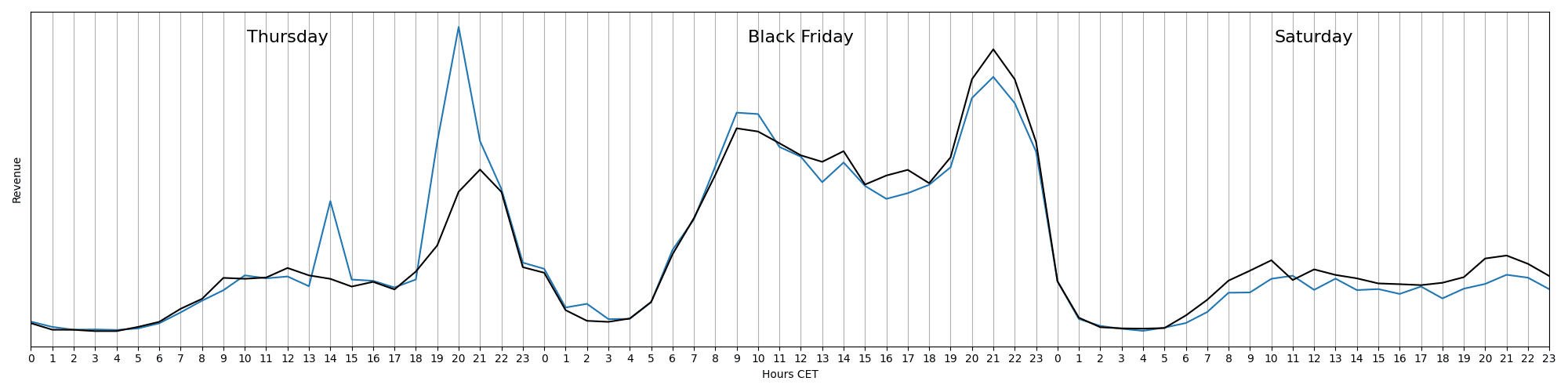

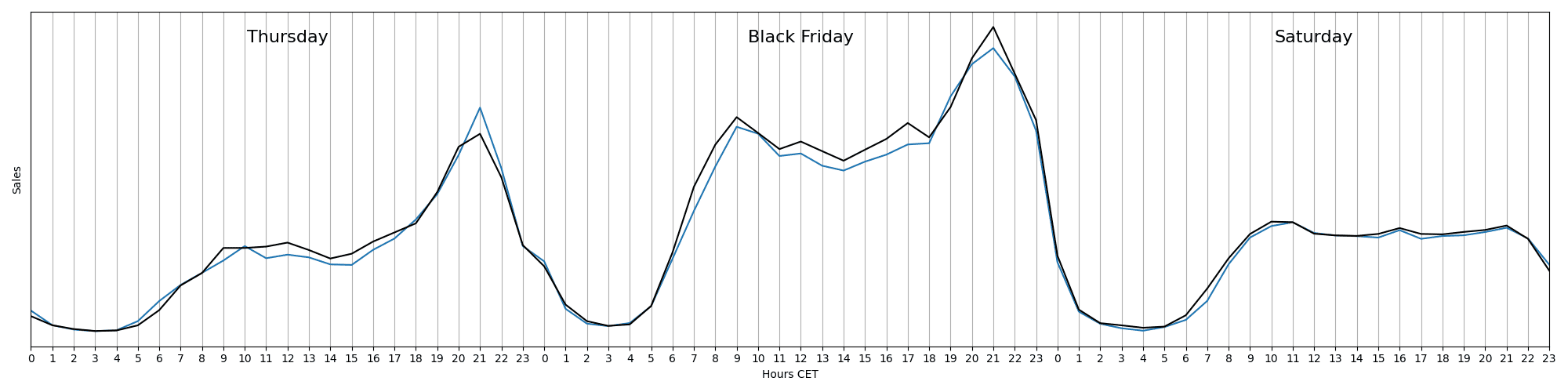

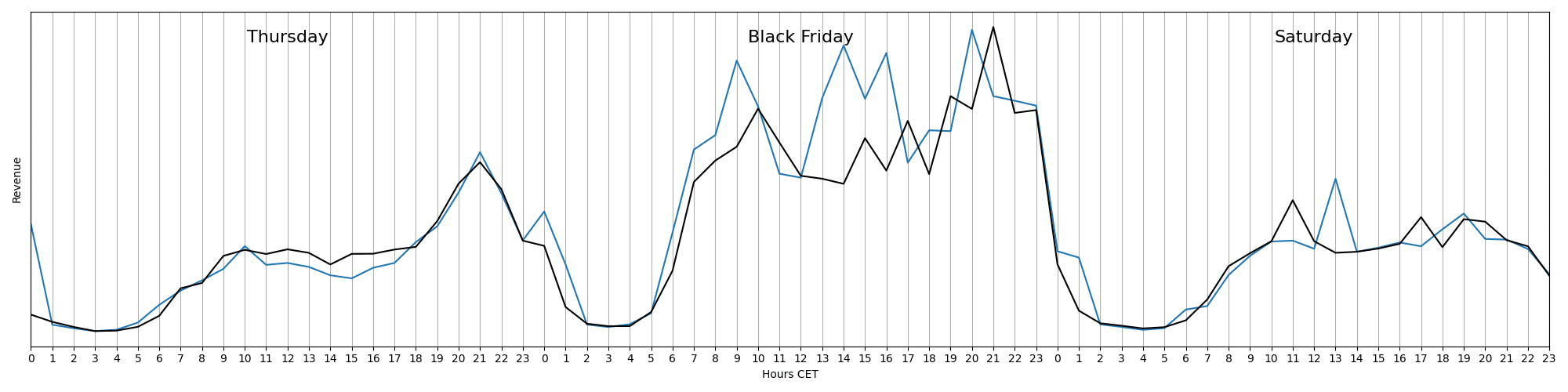

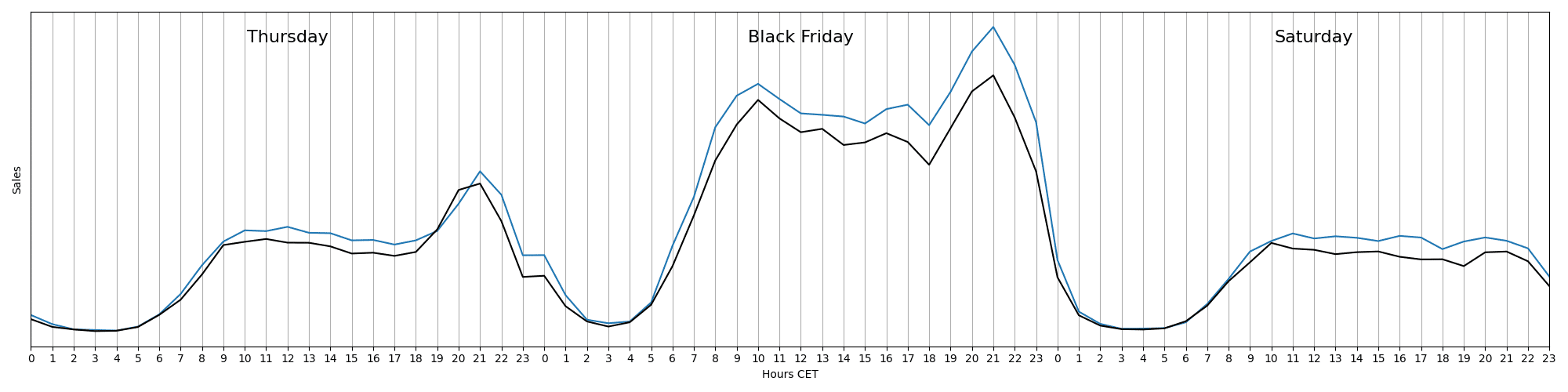

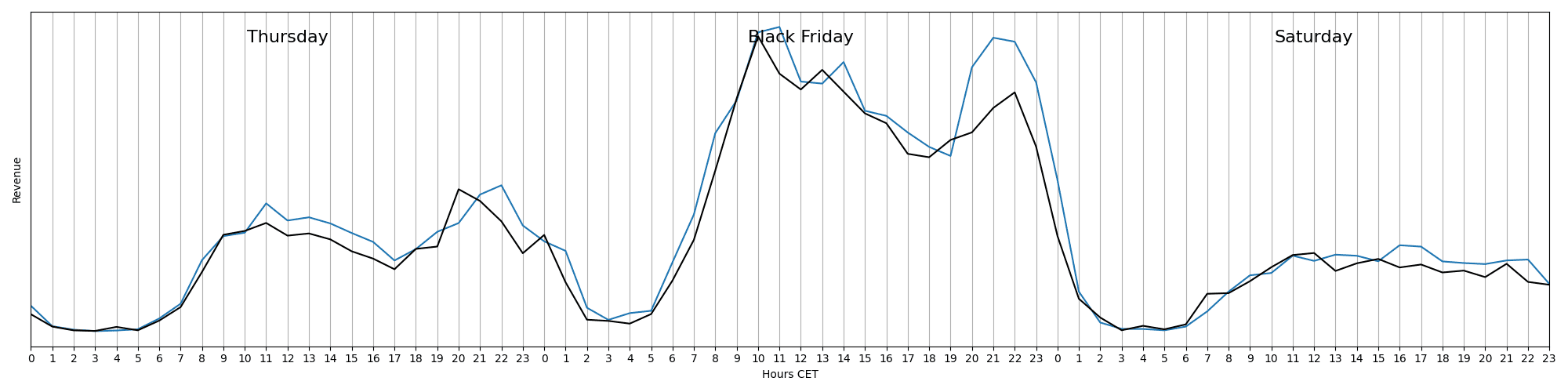

Diving deeper into the data, we can construct a timeline of Thursday, Black Friday and Saturday, in order to see when customers are shopping!

Below is the hourly development of these days plotted, going back to 2020. The x-axis is the time in CET, and the sales have been scaled according to the number of webshops. This is to ensure that data is accurate and doesn’t get skewed due to the high growth Hello Retail has had the last few years.

Here we see that the Black Friday shopping kicks off Thursday evening, between 21-23 CET, and then drops off, but at midnight the shopping starts again for an hour.

On Black Friday we see that the number of sales, each year, generally lies higher than the peak of Thursday evening, and that customers tend to do the majority of their shopping during 21-23 CET. This time window corresponds to 21% of the sales of the Black Friday. The following Saturday, the buying drops off again, and no spike in sales is seen afterwards. Comparing across the years, we see that this trend is consistent – we are, as humans, quite predictable.

We also see that 2022 and 2021 are quite comparable, but 2020 had more sales. During 2020, the world faced a pandemic, due to which physical stores were closed around the globe. During the pandemic, online businesses were flourishing, which may explain the higher numbers.

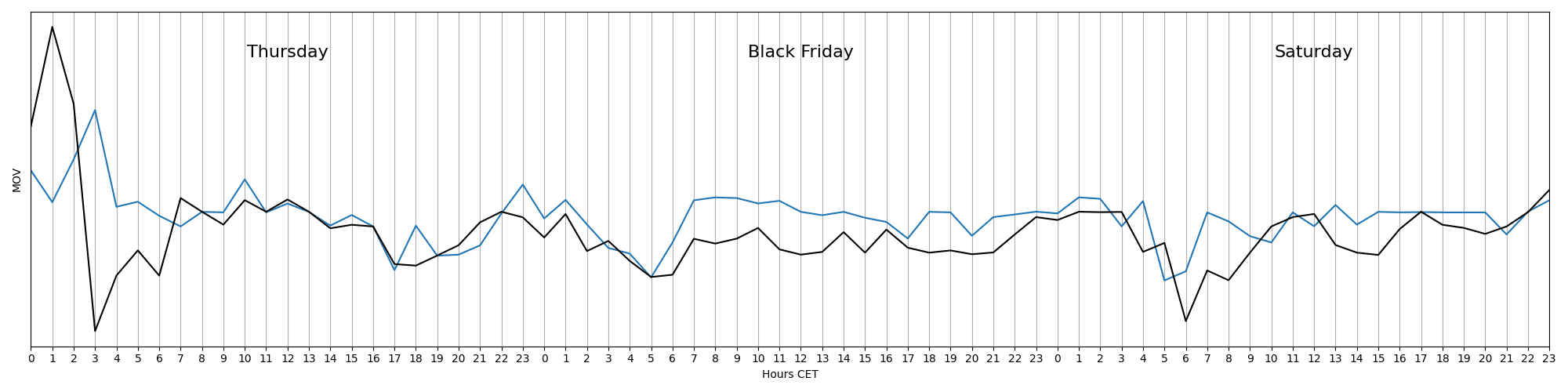

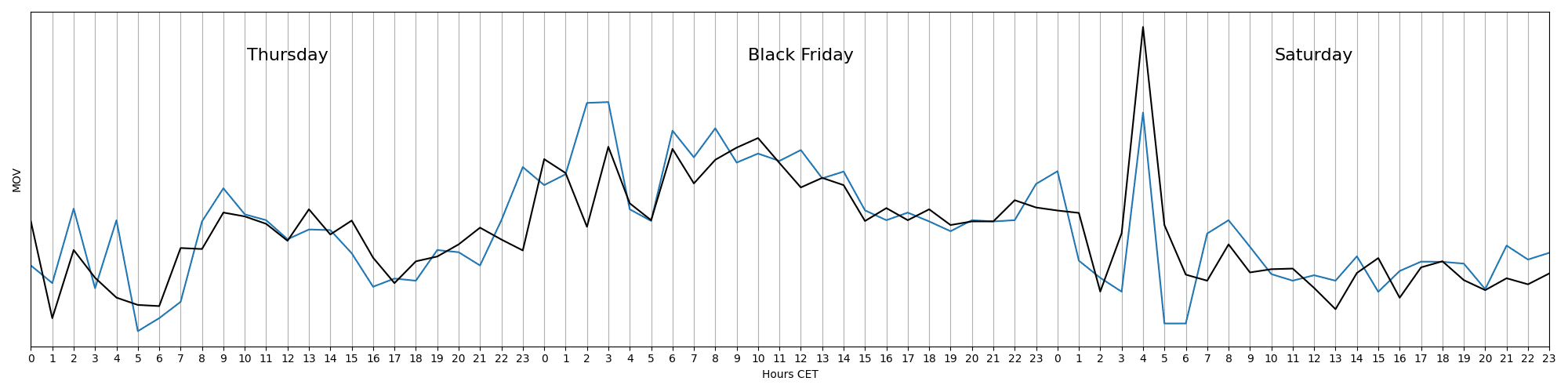

If we compare the Mean Order Value (MOV) over this time period, we can get insights into when customers are spending more!

We see that the MOV in 2021 generally was highest, while 2022 and 2020 are almost the same. The midnight shoppers are spending the most, then the MOV drops slowly over the course of Black Friday. This tells us that the higher value products are sold Thursday evening and in the morning hours of Black Friday.

The time period where the largest number of sales happen, corresponds with the time when the MOV is lowest during Black Friday. This trend is also consistent over the years, with the exception that the MOV in 2021 was slightly higher in the morning hours of Black Friday, than the evening before.

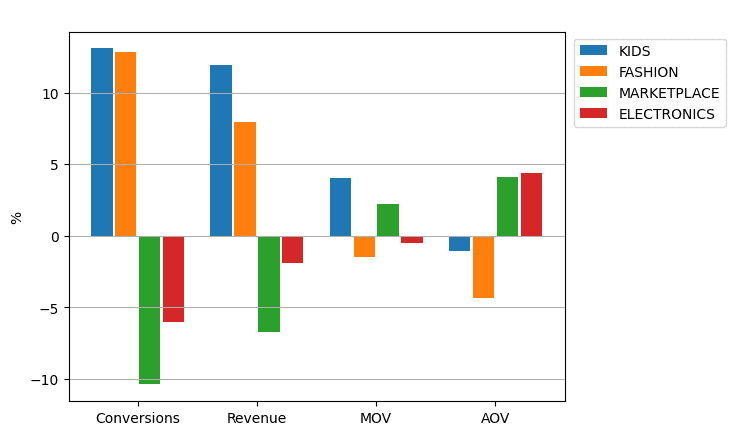

Kids, Fashion, Marketplace and Electronics

Not all shops sell the same and thus, it is not expected for them to be affected by Black Friday in the same way. Below, the percentage change in sales, revenue, MOV, and AOV between 2021 and 2022 is seen for four selected industries.

We see once again the difference in analyzing Black Friday and Black Week. Especially for the Fashion sector, as it took a large loss in revenue during Black Friday, but actually had an increase in revenue during Black Week!

The Kids industry

| Kids | Revenue | Orders | MOV | AOV |

|---|---|---|---|---|

| Black Friday | 3,3% | 6,1% | 4,0% | -2,6% |

| Black Week | 11,9% | 13,1% | 4,0% | -1,0% |

This industry has seen an increase in both sales and revenue. The sales have increased by 6.1%, while the revenue has increased by 3.3%. This improvement is further enhanced when looking at how Black Week went!

In this industry, the MOV has increased while the AOV has decreased. This is an indicator that customers are not buying expensive products. The MOV has increased which means that the more general receipt value is increasing. It might sound counterintuitive that the revenue is going up while the AOV is going down, but this is possible due to the increase in sales that this sector is seeing. We have done an hourly breakdown of Black Friday on the industry level which can be seen below.

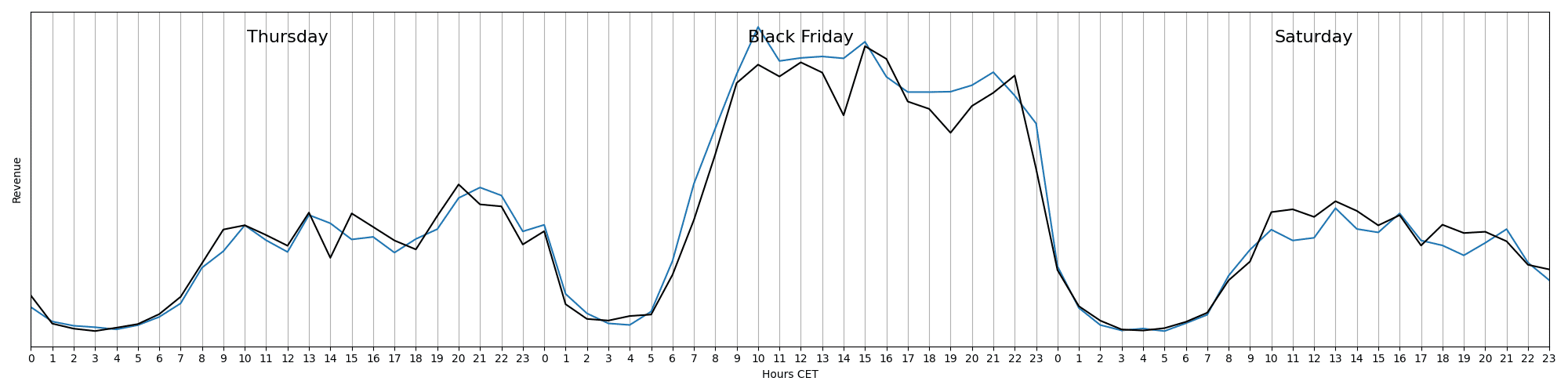

This industry has the same general trend that we saw for all shops. The sales and revenue are higher during Black Friday, but the peak on Thursday evening has been reduced dramatically. Thursday evening 2021 saw the same volume of sales as Black Friday evening 2021, which is not the case for 2022.

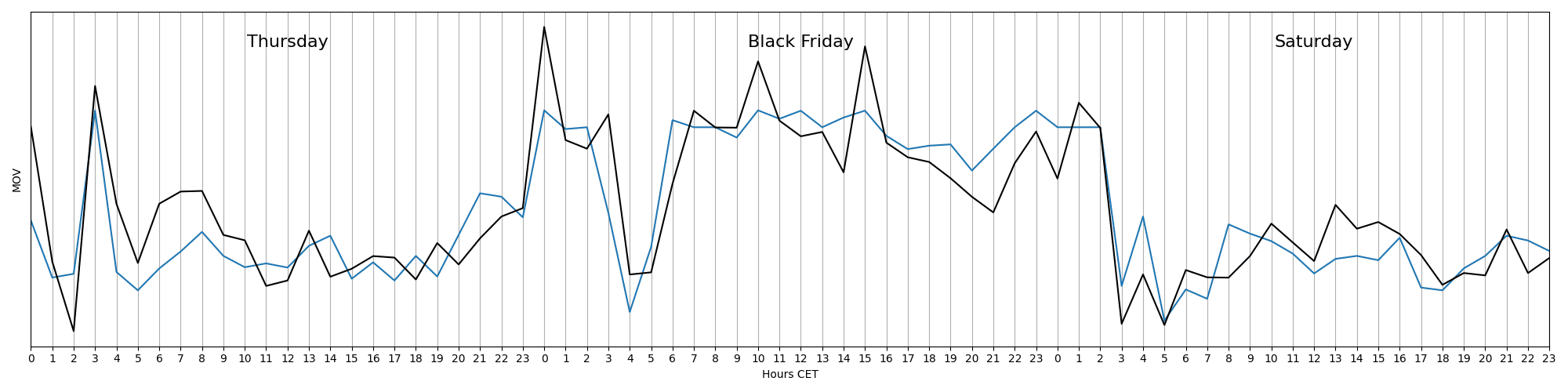

In 2022 the MOV is highest in the kids’ industry during Thursday evening, and it is then stable and higher than 2021 during Black Friday.

The spike during at 3.00 in 2021 comes from a small number of receipts and should not be regarded as a time of day where MOV is truly high.

The fashion industry

| Fashion | Revenue | Orders | MOV | AOV |

|---|---|---|---|---|

| Black Friday | -14% | 5,6% | -7,5% | -18,6% |

| Black Week | 7,9% | 12,8% | -1,4% | -4,3% |

This industry has an increase in orders of 5.6% for Black Friday, while the revenue has dropped by 14.1%. When looking at Black Week, there is a significant change for the Fashion industry, the revenue has increased by 7.9 %! There is a drop in both the MOV and AOV for Black Friday/week.

This suggests that a focus on cheaper variants of products might be beneficial for the Christmas season.

For the fashion industry we don’t see much deviation from the general trend across all shops. When comparing to 2021 we see that the conversions during Thursday evening are slightly down this year, but otherwise the industry is outperforming 2021 on conversions.

The story is different looking at the revenue. Here the midnight shoppers were spending more in 2021, and generally customers were spending more during black friday. The most noticeable feature is that the revenue peak at 13-16 CET in 2021 is severely reduced. Another change that is seen from this is that the time when the most revenue comes in has shifted by 1 hour back. The MOV is generally lower in 2022 compared to 2021 which is also reflected in the 7.5 % drop in MOV.

The marketplace industry

| Marketplace | Revenue | Orders | MOV | AOV |

|---|---|---|---|---|

| Black Friday | -12,3% | -13,9% | -1,4% | -1,9% |

| Black Week | -6,9% | -10,4% | 2,2% | 4,4% |

This industry has been hit hard on both sales and revenue, with a decrease of 13.9% and 12.3% on the two metrics. This drop is not as large looking at Black week, but there is still a drop in both sales and revenue.

The MOV and AOV have not changed much compared to last year, suggesting that customers are just buying less from this sector, but not changing the price range of what they are looking for.

In this industry we see that sales have dropped generally over the course of the whole period. The revenue for this year was actually close to the same level as 2021, until in the evening. Here there is a major difference between 2021 and 2022, and it is during the evening hours that the majority of the loss in revenue is seen.

In the above two industries the evening shoppers are generating more revenue, but this is not the case for Marketplace. From the MOV we see that it is dropping slightly over the course of the day, and that in 2022 on Black Friday it was highest in the morning hours. The spike at 4.00 CET on Saturday should be disregarded because very few sales are seen in the time and thus a few large receipts will have a large impact on the MOV.

The Electronics industry

| Electronics | Revenue | Orders | MOV | AOV |

|---|---|---|---|---|

| Black Friday | -7,7% | -10,1% | -7,1% | 2,6% |

| Black Week | -1,9% | -6,0% | -0,4% | 4,3% |

This industry has also seen a drop in sales of 10.1% while the revenue has dropped by 7.7%. The drop in sales and revenue is also seen when comparing Black week. The MOV has dropped by 7.2% while the AOV has increased by 2.7%. This drop in the MOV suggests that customers are placing lower value receipts than last year, and it might be beneficial to focus on the cheaper variants in the coming Christmas season.

The Thursday and Saturday sales and revenue are almost the same in 2021 and 2022, but the Black Friday sales and revenue is down. In this industry it is interesting to see that there is not a large increase in sales during 20-22 CET, but the sales are more stable throughout the day.

When looking at the MOV it is interesting to see how this almost doubles during Thursday evening and Black Friday. The MOV does not follow the same pattern that we saw across all the shops, it is generally more stable during the day, with only a slight drop in the early evening hours.

To wrap things up

From the data it is clear that despite the difficulties of this year, customers are still engaged in shopping but they are more cautious with their money. From the dive into the different industries, we see that customers are converting less in the Marketplace and Electronics, while they actually convert more in Kids and Fashion.

We are also seeing that Black Friday itself has been hard, but when looking at Black Week, the numbers are not as bleak. For the Kids and Fashion industry, a move to Black Week made a huge improvement in both sales and revenue!

Now that the dust has settled from Black Friday, webshop owners have the Christmas season to look forward to. Following the trend of Black Friday, we can probably expect customers to still do their Christmas shopping but with an affinity for cheaper products.

You can look at our Tuesday tips and previous blog post if you would like to prepare your webshop for Christmas.